Increase in Credit Card Fraud during the Holidays

In 2015 U.S. consumers spent over $70 billion on Black Friday and spent, on average, $830 billion on Christmas and holiday gifts. U.S. consumers spend more during the winter holidays than at any other time of the year. Unfortunately, this increase in spending creates a greater opportunity for scammers who prey on shoppers and, naturally, there is a significant increase in credit card fraud during this time of year.

One of the most common ways that credit card thieves steal your information is through the use of credit card skimmers. Skimmers are essentially malicious card readers that grab the data off of the card’s magnetic stripe attached to the real payment terminals so that the thieves can harvest data from every person who swipes their cards. This can usually be avoided by learning how to spot a skimmer or by using a card that has an RFID chip, however, they have their risks as well. Additionally, some thieves will even more advanced methods of stealing information, by hacking.

Back in December of 2013 the second-largest discount retailer in the U.S., Target, released a statement regarding a historically large data breach. Credit thieves had stolen credit card information from over 70 million Target shoppers. The scammers had found a way to steal credit card information from shoppers without them even knowing. During the influx of holiday shopping, credit card thieves hacked into Target’s network to gain access to their POS terminals and intercept consumer credit card data without them even knowing.

Avoiding Credit Card Fraud While Shopping in Retail Stores

As I mentioned previously, to avoid having your credit card information stolen while using a credit card or payment processing terminal due to skimmers, many people resort to using the RFID chip reader when checking out. Unfortunately, RFID chips have their own security risks. Since the RFID chips emit a low-frequency signal that can be intercepted without even coming into direct contact with the receiver, they also pose a threat. Thankfully, though, to avoid having your information stolen via a fraudulent RFID scanner, you can simply purchase an RFID-blocking wallet or purse.

While paying using your RFID-enabled card can help you avoid skimmers, there is always the possibility that your information could be intercepted after payment is submitted by a hacker, such as those who infiltrated Target’s network. That type of situation is much rarer but it’s still good to be aware of the possible security risk. For that reason, we suggest using cash when shopping during the holiday season.

The benefits of using cash while shopping, especially during the holiday season when there are so many fantastic specials and deals, go beyond the safety of avoiding card theft. Credit card debt is also a huge problem in the U.S. and much of that is due to frivolous spending during the holidays. Bringing a set amount of cash with you while shopping can help prevent overspending. This can also help you avoid damaging your credit.

How to Shop Safely Online

In 2015 consumers spent over $69 billion online during the holiday season. Making purchases online is convenient and can save considerable time while avoiding the stress of overcrowded malls and retail stores. Making purchases online can also help you avoid credit card thieves who use credit card skimmers or RFID scanners to steal your information. Websites, however, have their own set of security risks and many people are not familiar without to spot a phony website or a non-secure site that could leave your credit card information vulnerable.

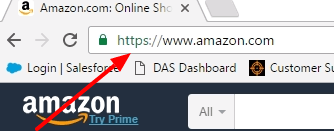

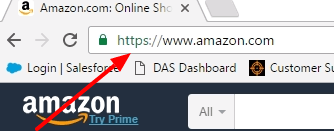

Any time you are shopping online, make sure that you first identify that the website is using an SSL certificate. You will notice, in the address bar, that the website contains a padlock icon and the address is listed as “https” as shown below:

Despite taking every precaution, it is still recommended that you check your credit report regularly to catch any possible credit card fraud or identity theft before it destroys your credit. If you notice items on your report that you don’t recognize (such as new lines of credit being opened), file a report with the Federal Trade Commission (FTC) immediately. If your credit has already been damaged, due to credit card fraud or identity theft, contact Credit Absolute for a credit consultation.