FICO scores have been used for a long time to gauge the creditworthiness of individuals. This scoring system has however left many people in the cold due to its requirement of credit history; immigrants, people who don’t use credit cards or have no loans, as well as those with low FICO scores, have been finding it hard to qualify for financing or opening lines of credit.

To remedy this Fair Isaac Corp, the company behind FICO scores is set to launch UltraFICO credit scores. This refined system is being marketed as one that ‘enhances your credit score based on indicators of responsible financial behavior’.

So, what is UltraFico and what do you need to know about it? Read on to find out.

What is UltraFICO

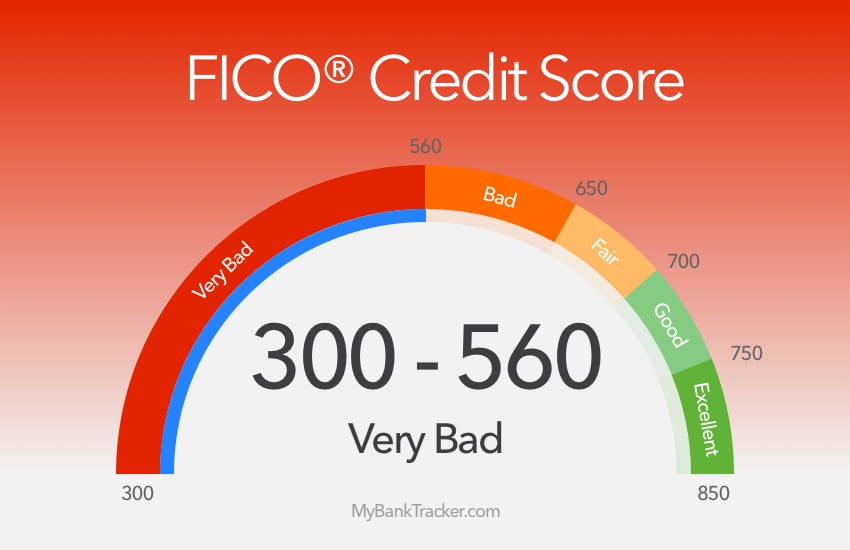

This is a new credit scoring model that debuted in early 2019. It will be an opt-in service that will be targeted at individuals with bad credit or in the range of fair credit, (500s and 600s FICO score range).

Who will Benefit from UltraFICO Scores?

The new model in all likelihood will increase such low scores provided that you have moderate savings with no negative balances in the last three months. This ambitious plan by Fair Isaac Corp in conjunction with Experian, a leader in credit reporting, and Finicity, a financial solutions provider, is set to benefit several classes of consumers;

- Immigrants

- Freelancers and the self-employed

- Former bankruptcy

- Fresh graduates

These are people without credit history or whose history has been damaged due to previous mismanagement of personal finances. This category of consumers also includes divorced spouses who never got to develop their own credit history.

As of September 2018, 22% of consumers had credit scores in the 600-699 FICO score range. These are customers who could improve their creditworthiness if only they could get a positive bump in their scores; these are people whose scores can change for the better with UltraFICO scores.

With the new scores, you don’t have to have a proven debt record to secure financing. People who don’t deal with credit cards or those who have never had to take a loan will now have a credit score to show.

Factors that Affect UltraFICO Scores

Linking your bank accounts to UltraFICO will help in determining your new credit score. Your banking activities such as the amount of savings and balances will factor into this. The information from your accounts such as savings and credit that will be scrutinized includes;

- The time that an account has been active

- Frequency of using the account

- Amount of savings and saving habits

- How well do you clear bills

This information will be used by lenders to determine the credit that you qualify for and the terms that suit you. The new scoring system promises to favor a huge number of customers who could previously not get financing.

The Downside of UltraFICO

Although the new system comes with good news for some consumers, some industry experts have raised issues. Here is why:

Trapping more people into debt

The strictness of the current scoring system ensures that consumers are protected from debt. With the new scores, even people with sketchy debt history will probably get into more debt. In essence, it opens up loaning to people who can’t pay it back.

Bank and other lenders will be the biggest beneficiaries

The new scores will be launched with the aim of helping more people get credit. However, there is the feeling that this is just a ruse to make lenders make more money. This will be from the high interest that will be charged from this new class of borrowers that are likely to default.

Lack of financial security

One of the requirements for UltraFICO is a balance of not less than $400 in savings. This has been seen as setting the bar too low with arguments arising that the amount is too low for financial security.

The Bottom Line

UltraFICO is the new credit scoring system due to be launched early next year. It’s targeted at making more people qualify for different lines of credit. It will offer second chances to people with bankruptcies and open up financial products to people without credit histories. That said, UltraFICO may end up leading more people to debt, increasing defaulters, and creating a false sense of security.

While this new scoring system may help those with poor credit histories get approved for loans, it will come at a heavy cost. If you have a low credit score due to negative items on your credit report, a credit repair specialist can help you increase your credit score quickly by cleaning up your credit report. Rather than risking further damage to your credit with the UltraFICO system, work to repair your credit for long-term financial freedom.